The Importance of Commission Payout Timing

Let’s say you agree to pay someone $10,000 to fix your roof. You weigh your options on how to pay them.

- Do you pay them $10,000 upfront?

- Do you pay them $5,000 upfront and promise $5,000 upon completion?

- Do you write them a check for $10,000 that can only be cashed after the completion date?

Why do you debate the above questions? $10,000 to fix a roof is $10,000 to fix a roof. However, as in many instances, you debate the above questions because you know that timing matters and can significantly impact human behavior. The same goes for timing of sales commission.

When Do People Pay Commission?

A study by the Bridge Group reported the following results.

- 38% of SaaS companies pay commissions when cash is collected

- 35% pay commissions at booking

- 20% pay commissions when invoicing the customer

What’s the Best Payment Model for My Business?

Paying When Cash is Collected

Pro: Allows you to maintain healthy cash flows.

Con: Can be demoralizing for your sales team. The potentially long lag time between closing the sale and collecting payments means that you’ll keep your sales team waiting for an unknown amount of time.

Paying at Booking

Pro: Ideal for keeping your sales team energized. After all, what better feeling than hanging up a successful sales call and knowing that you’ll have extra funds in your next paycheck to celebrate with champagne?

Con: This can potentially be damaging to cash flows and can turn into a challenging situation if a client reneges on a contract.

Paying at Invoicing

The in-between option is paying commission when the invoice is sent to the customer. However, this is likely the least popular option because you don’t really garner the benefits of immediately rewarding your sales person, nor do you garner the benefits of favorable cash flow.

The Hybrid

There is a way to keep your sales team motivated while also protecting your cash flows. Reward your sales team upon booking, but insert a clawback clause which states that the commission shall be returned if the customer churns or reneges.

Not only is this a great way to balance motivation and cash flows, it’s also a great way to incentivize the sales team to nurture a long-term relationship with clients.

Let Data Transparency Help Decide What’s Best For Your Sales Team

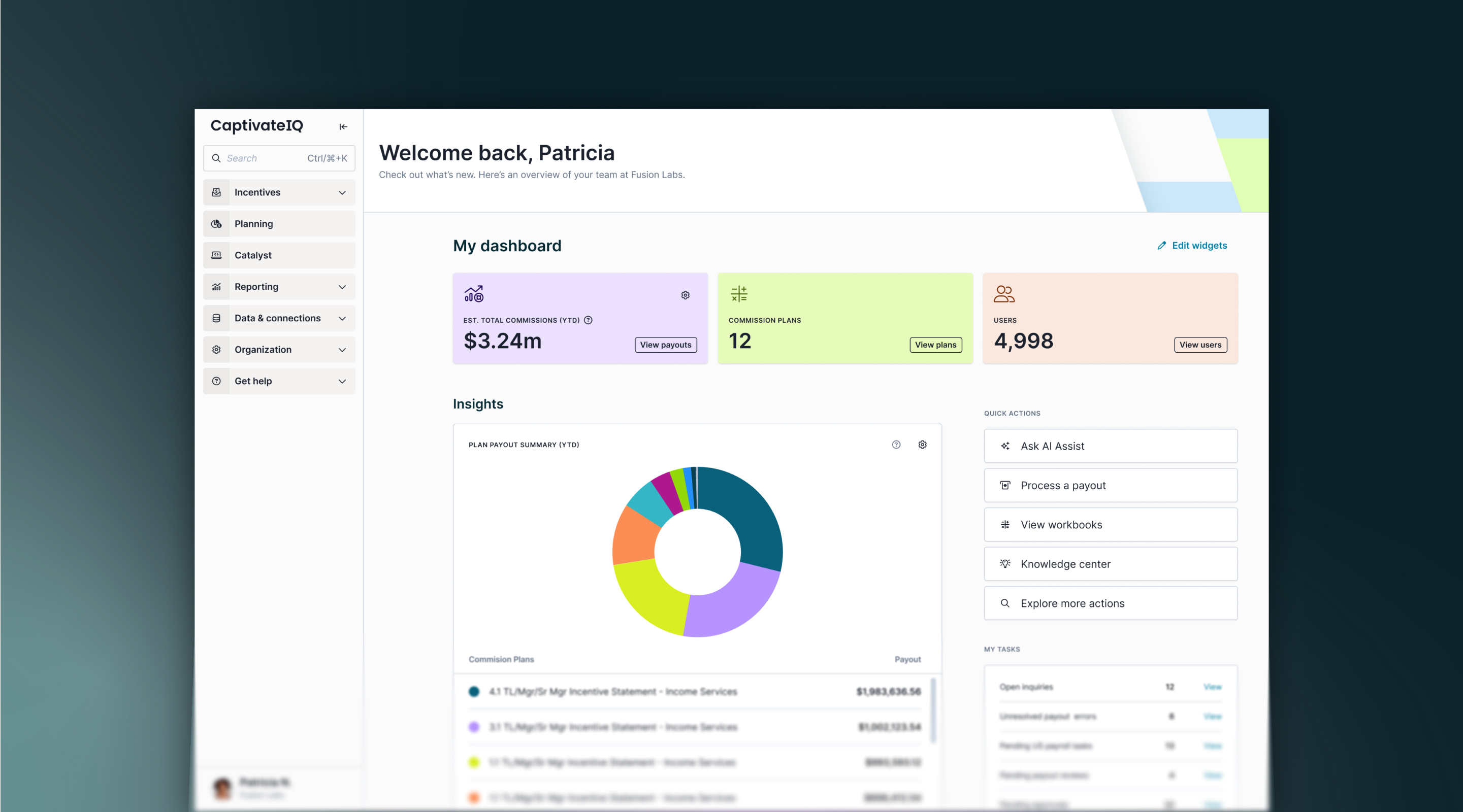

When considering a commission payment plan, you can easily see how your business will be impacted with CaptivateIQ’s simulation tool. Simulate any payout plan for any combination of employees, commission structure, and pay period.

.svg)