What Are On-Target Earnings (OTE) in Sales? Everything You Need to Know

At the end of every quarter, sales reps do the same math: “Did I hit my number? And what does that mean for my paycheck?” The answer lives in three letters: OTE.

On-target earnings, or OTE, define what sellers take home when they meet their sales quota. But more than a number on a job description, OTE is an important part of your compensation strategy. Get it right, and you motivate performance, attract top talent, and manage your revenue with confidence. Get it wrong, and you risk missed targets, rep churn, and a compensation structure nobody trusts.

In this guide, we’ll break down what OTE actually means in sales, how leading revenue teams structure it, and what kind of OTE models support efficient, performance-driven teams.

Let’s get into it.

What Are On-Target Earnings (OTE) in Sales?

OTE salary (or OTE or On-Target Earnings) is the total compensation a seller earns if they meet (or exceed) their sales quota. OTE includes:

- Base salary, which is guaranteed pay, regardless of performance.

- Variable compensation, which is typically sales commissions or bonuses tied to quota attainment.

For example, if a rep’s base salary is $70,000 and they can earn $70,000 in commission for hitting quota, their earning potential is $140,000.

Some companies may include equity, performance bonuses, or SPIFFs in their OTE calculations. We’d argue that 99% of the time, OTE compensation will be base + on-target variable (OTV). OTV estimates how much a salesperson can earn if they meet or exceed their sales targets.

Keep in mind that OTE should always reflect the same time period as the quota. If quota is annual, OTE is annual. If you operate on quarterly quotas, the OTE should be prorated accordingly.

How do You Calculate OTE?

The most straightforward formula for calculating on-target earnings is:

OTE = Annual Base Salary + Annual Commission Earned at 100% Quota

This assumes a flat-rate plan where the rep earns a predictable amount at full attainment. In reality, many comp plans add nuance (e.g., tiered rates, bonuses, or accelerators), but the basic math starts here.

Let’s look at a couple of examples.

Example 1: 50/50 Pay Mix

A rep earns:

- $50,000 base

- $50,000 commission for hitting 100% of quota

OTE = $100,000

If that rep only hits 50% of their quota, they earn $50,000 base + $25,000 variable = $75,000 total comp.

Example 2: Commission Rate on Monthly Quota

Say a rep has:

- $30,000 base

- $40,000 monthly quota

- 5% commission rate

Monthly variable pay (at target) = $40,000 × 5% (per month) = $2,000/month

Annual variable pay = $2,000 × 12 = $24,000/year

OTE = $30,000 base + $24,000 variable = $54,000

What are the Benefits of an OTE Model?

Compensation clarity is non-negotiable for sales teams. Reps want to know what they’ll earn, and leaders want to know what they’re paying for. An OTE model brings structure to both.

It Sets Expectations From Day One

OTE gives reps a real number to work toward. Not a vague sense of “competitive pay” or a promise of upside. Just: hit your number, earn this much. It also gives finance, sales, and hiring managers a shared reference point that makes it easier to plan headcount, align on targets, and avoid debates about whether someone’s comp “feels right.”

It Makes Comp Planning Less Chaotic

With OTE, you have a starting point. You’re not building every offer from scratch or trying to reverse-engineer pay based on gut feel. You can compare roles, align levels, and keep ranges consistent across teams and territories. That structure makes it easier to grow without ending up with a dozen one-off comp plans no one can explain.

It Keeps Payout Aligned With Impact

When variable pay is tied directly to quota, it forces the question: are we rewarding the right outcomes? OTE makes that connection visible. If your business priorities change (toward upsell, expansion, or product adoption), you can adjust targets and variable comp without overhauling the entire plan. It’s a flexible structure, yes, but not a vague one.

How Do You Set Up an OTE Model?

Most bad compensation plans don’t look broken at first. The math works. The spreadsheet loads. But the results tell a different story: reps missing quota, teams misaligned, earnings out of sync with impact.

That’s a planning issue more than a payout one.

A solid OTE structure doesn’t start with what you want your people to earn. It starts with what they need to deliver and works backward from there. When all is said and done, the goal is to set targets that are ambitious, achievable, and tied to the real economics of the business.

Start With Base Pay

OTE gets the headlines, but base pay is where the model actually starts. It’s what you budget for, it’s what candidates negotiate, and it sets the floor for total comp, no matter how the quarter goes.

Once you know what you’re paying as a base, you can begin to shape the rest. Variable comes later, and so does quota. But everything starts here.

Set Quotas

If OTE is the promise, quota is the proof. One without the other doesn’t mean much.

You can offer a $200K OTE, but if the rep needs to close $5M to earn it, the math breaks. You haven’t created motivation, you’ve just built a trap. Flip it, and you’re paying full freight for partial impact, a disconnect that erodes both performance and trust.

So what’s a good quota-to-OTE ratio? Well, it depends.

In mid-market SaaS, we typically see ratios in the 1–3x range. So a $150K OTE might be paired with a $450K quota. But in industries with high-volume, low-touch sales (or where reps have less direct control), quotas can stretch much higher. In some non-tech orgs, ratios as high as 10–20x aren’t uncommon.

That kind of spread makes comparisons tricky. Two companies selling similar products may still justify wildly different quotas based on one variable: win rate. If Company A wins 66% of head-to-head deals and Company B wins 34%, setting the same quota for both is a mistake. Same market, same ICP, but the rep effort required to close a deal isn’t even close.

This is why rigid benchmarking can be dangerous. It ignores context like deal size, sales cycle length, territory makeup, support structure, and rep capacity. Ratios are useful guides, but they should never override what your numbers actually say.

What you want is a quota that earns the OTE and is still attainable. If reps aren’t hitting it, dig deeper before assuming they’re underperforming. Look at pipeline coverage. Look at conversion rates. Look at how the comp plan rewards effort. Then adjust.

Our friends at The Alexander Group put it perfectly:

“Analysis of quota performance distributions yields a wide range of insights to improve the quality of your quota program and thus the performance and health of the sales force and the ROI on your sales investment. Determine which sub-groups to review based on the structure of your organization and your sense for specific problem and opportunity areas. From there, you can formulate hypotheses about root causes, dig deeper where needed, and more importantly, change how you set goals next year.”

Match the Pay Mix to the Role’s Influence

Once base pay is locked in and you’ve defined a realistic quota, you can shape the comp structure that sits in between. Pay mix (base vs. variable) is how you tell the rep: here’s how much control we believe you have over the outcome.

That message needs to be deliberate. If it is misaligned, you will either overpay for predictable outcomes or under-incentivize the very behaviors that drive growth.

For example, reps closing deals on net-new business (typically account executives) usually sit at a 50/50 split. That’s the benchmark we see most often across our customer base, and it reflects the direct impact those roles have on revenue. The upside is real, but so is the risk. Reps know where they stand and what’s expected.

Other roles carry less variable weight. In pre-sales and pipeline gen functions like BDRs or SDRs, variable comp usually sits around 30% of OTE. These are early-funnel roles. They influence revenue, but they don’t control it, so the comp structure leans toward stability.

Renewals and post-sale roles fall even further down the spectrum. Account managers tend to hover near 20% variable, and sales engineers fall between 20% and 30%, depending on how tightly they’re tied to deal outcomes. These are important roles, but not ones that should be gamified by aggressive quotas or stretch multipliers.

The takeaway here is that each structure needs to match the reality of the role. When comp and control are aligned, teams perform better, and fewer people end up questioning the fairness of the plan.

Don’t Let Metrics Dilute the Message

It doesn’t matter how competitive your OTE is if no one understands how to earn it. When comp plans get too complicated (too many levers, too many exceptions, too much math), you don’t get motivation. You get confusion.

According to our benchmark data, most companies stick to two to three core metrics per plan. Not because they lack creativity, but because they acknowledge that clarity is a performance driver.

You don’t need to capture every behavior in your plan. You need to be clear about which ones matter most. Reward those. Track those. Let the rest be supported through coaching, enablement, or process, instead of buried in the payout formula.

What is the Average OTE in Sales?

It’s always tricky to talk averages, as many factors go into what a salesperson can expect to make (from industry, to segment, deal size, seniority, and geography). But industry standards can still be useful if you treat them as what they are: a directional pulse, not a prescription.

According to our 2025 Sales Compensation Benchmarks Report, the average OTE across all sales roles is $174K, with a median of $150K.

For some standard guidelines across roles, below we look at numbers for sales development reps, account executives, and sales managers.

Average OTE for Sales Development Representatives (SDRs)

According to Glassdoor,* in the United States, at all experience levels, in all industries, as of April 2025, an SDR can expect a median OTE of $123k per year with $52k to 93k base pay + $40k to $75k variable pay (which could include “cash bonus, commission, tips, and profit sharing”).

Indeed puts that average at $89.9k per year ($79.3k base + $10.9k commission).

Our friends at RepVue cite the medium OTE for an SDR at $85k ($55k base + $30k variable).

*Glassdoor allows you to change location, experience, and industry to hone in on a more accurate number.

Average OTE for Account Executives

According to Glassdoor, an enterprise AE can expect an average OTE of $248k per year, with $91k to 151k in base pay and $94k to176k in additional pay.

Indeed puts that average at $138.5k annually (they don’t break down by base/commission).

RepVue breaks down medium OTE based on segments:

- Enterprise Account Executive: $260k ($130k base + $130k variable)

- Mid Market Account Executive: $170k ($90k base + $160k variable)

- SMB Account Executive: $130k ($70k base + $60k variable)

Average OTE for Sales Managers

As per Glassdoor, a Sales Manager can expect a median OTE of $126k per year, with $59k to $100k in base pay and between $37k and $69k in variable pay.

RepVue bumps this up to $265k per year ($140k in base pay and $125k in variable pay).

OTE Only Works When It’s Built Right

OTE looks simple enough from the outside: a single number, a headline offer. But behind that number is a set of decisions about expectations, motivation, fairness, and impact.

When it works, OTE creates alignment. Reps know what they’re working toward, leaders know what they’re paying for, and the connection between performance and payout stays intact.

When it doesn’t? You feel it everywhere. Quotas get missed. Plans get ignored. Trust starts to slip.

That’s why how you build your model matters just as much as what you pay.

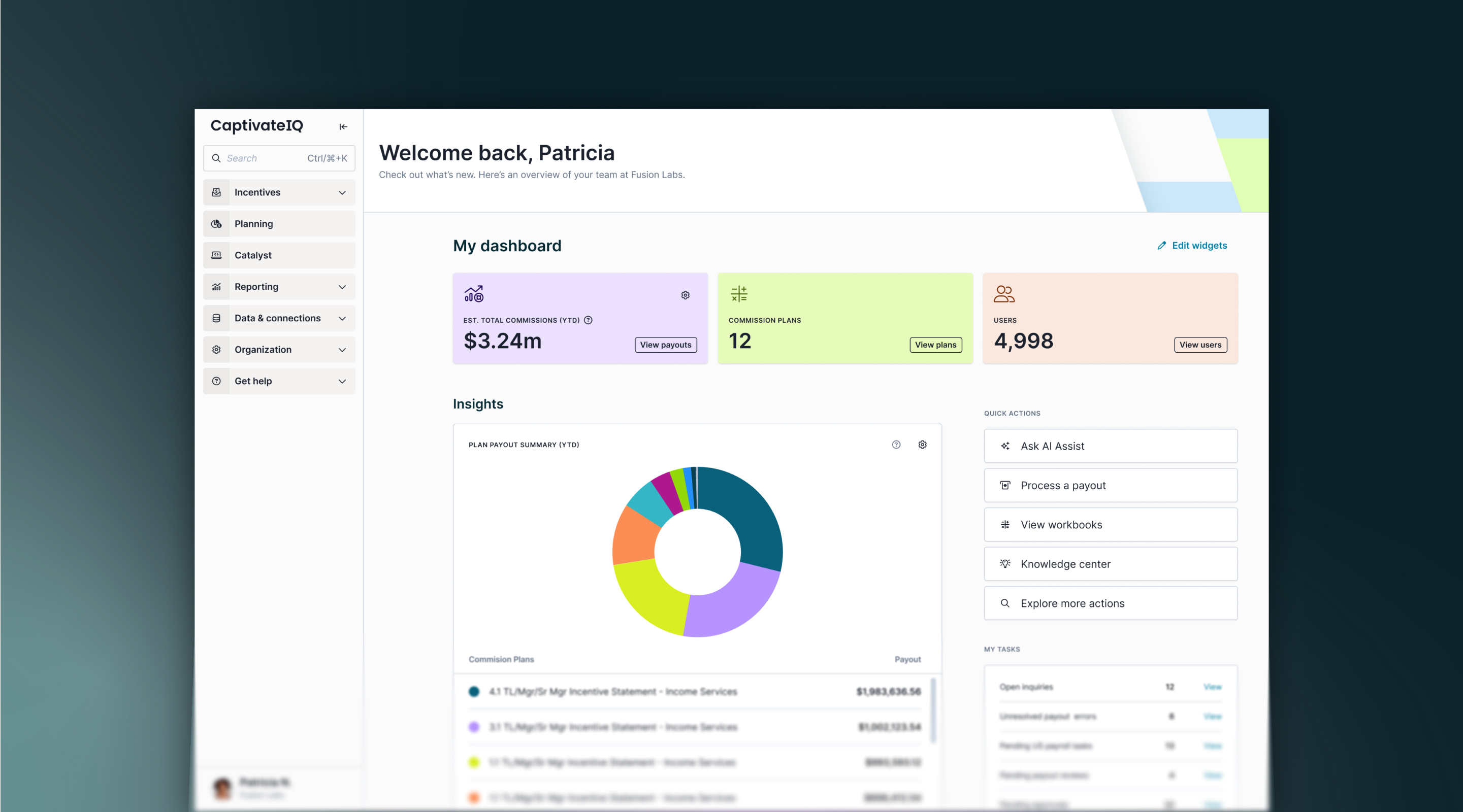

CaptivateIQ gives you the visibility, flexibility, and control to do it right, from modeling OTE scenarios to aligning comp plans with real performance data. There is no guesswork, no buried formulas. Just a compensation engine that matches the reality of how your team sells.

If your OTE model needs more than a spreadsheet and hope, we should talk.

Book a demo and see how CaptivateIQ makes sales compensation, planning, and sales performance actually work.

What is OTE in Sales? Frequently Asked Questions (FAQs)

Is Equity Part of OTE?

Sometimes. Some companies include equity or stock options in OTE, especially in earlier-stage startups or for senior sales roles. But that’s the exception, not the rule. Most organizations stick with the base + variable formula to keep compensation transparent and predictable.

What’s the Difference Between OTE and Total Compensation?

OTE is a projection. It’s what a seller would earn if they hit their number. Total compensation is actual. It’s what they end up earning based on performance.

If a rep hits 90% of quota, they’ll earn 90% of their variable pay, and their total compensation will fall short of OTE.

Does OTE Include Bonuses or Equity?

It can. Most OTE models include base + commissions or variable pay tied to quota. Some roles, especially in startups or sales leadership, also bake in bonuses or equity. If it’s consistently expected and tied to performance, it may be counted in OTE (but not always).

What’s a “Good” OTE?

There’s no universal answer. A “good” sales OTE reflects the complexity of the sale, the rep’s level of influence, and the market expectations for that role. Our benchmark data shows a median OTE of $150K, but the number depends on what the rep is being asked to deliver, whether that target is actually attainable, amongst other things (e.g., role, location, industry, seniority).

What’s the Ideal Pay Mix for Sales Roles?

It depends on the role. For example:

- AEs typically sit around 50/50 (base/variable).

- BDRs/SDRs skew more base-heavy, around 70/30 or 80/20.

- Renewals or post-sale roles may go as low as 80/20 or 90/10.

The more control the sales professional has over the outcome, the more variable their comp tends to be.

.svg)